Successfully Getting Credentialed with Insurance Companies: A Step-by-Step Guide

Embarking on the journey of becoming a healthcare provider involves more than just having the right qualifications and passion for helping others. A critical step in establishing a successful practice, especially for those in the mental health field, involves getting credentialed with insurance companies. This process can be daunting, but with the right guidance backed by CBM Medical Management and their 40 years of experience in Revenue Cycle Management and Practice Start-up, it can be navigated smoothly.

Understanding Credentialing

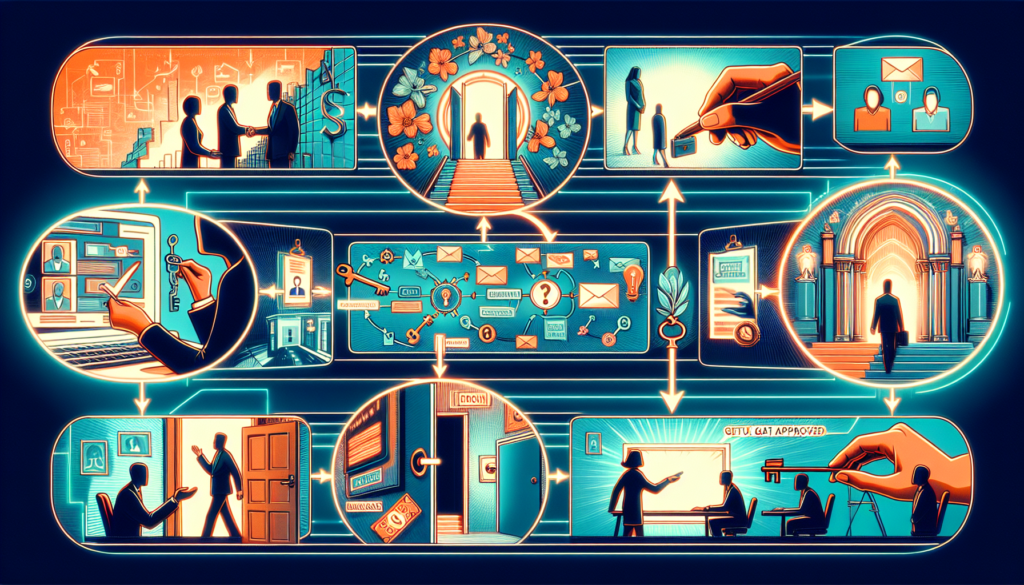

Credentialing is the process of getting approved to provide services to patients under specific insurance plans. It is the gateway for healthcare providers to connect with a wider range of patients and ensure a steadier stream of clientele. Picture it as a bridge connecting your expertise to those in need, through the world of insurance coverage. But how do you build that bridge successfully?

Step 1: Prepare Your Documentation

First things first, gather all the necessary documents. This will typically include your resume, medical license, proof of malpractice insurance, and certifications. Detail and accuracy here are key—missing or outdated information can lead to delays in the process.

Step 2: Identify Insurance Panels

Next, decide which insurance companies you want to work with. Consider the needs of your target patient demographic and research which insurers are most popular in your area. It’s about meeting your future patients where they are, insurance-wise.

Step 3: Submit Your Application

Once you have all your documentation and a list of targeted insurers, it’s time to apply. This can often be done online, but some insurers may require a paper application. Expect this step to be time-consuming and, at times, a bit repetitive. Patience is a virtue here.

Step 4: Follow Up Regularly

After submitting your applications, follow up every few weeks. Insurance companies are dealing with numerous providers and applications, so a gentle reminder about your application can help keep you on their radar.

The Role of Credentialing Services

If this process seems overwhelming, you’re not alone. Many healthcare providers turn to specialized credentialing services to navigate this complex process. These services can significantly streamline your efforts, ensuring accuracy and timeliness in your applications.

Frequently Asked Questions

- How long does the credentialing process take? Typically, it can take anywhere from 90 to 120 days, depending on the insurance company.

- Can I start seeing patients before the process is completed? Generally, no. It’s crucial to be fully credentialed before you begin billing insurance companies for services.

- Will I need to re-credential? Yes, re-credentialing is usually required every few years to ensure that all of your information remains up-to-date.

Conclusion

Getting credentialed with insurance companies is a pivotal step for any healthcare provider looking to establish or grow their practice. By following a structured approach and considering the support of professional credentialing services, you can navigate this process more smoothly and focus on what you do best—caring for your patients. With persistence and the right support, you can bridge the gap between your valuable services and the patients who need them the most.